Michael Lewis, head of ESG thematic research at asset manager DWS, examines what the state of global biodiversity means for the financial services sector

When people speak about biodiversity and its value, what specifically are they referring to?The UN Convention on Biological Diversity defines biodiversity as the variability among living organisms from all sources, including terrestrial, marine and ecological complexes. Nature, or ecosystem services, confer significant benefits to humans, from the provision of food, fuel and fibre, to the purification of air and water and the discovery of new medicines.

Ecosystems can therefore be described as ‘environmental assets’ that, like other capital assets, provide a flow of services over time. At a global level, the WWF’s Living planet report 2018 estimates that nature provides services worth at least US$125tn per annum. But, it says, since 1970, humanity has wiped out 60% of the population of mammals, birds, fish, and reptiles. The Business & Sustainable Development Commission’s 2017 Better business, better world report reveals that, after violence and armed conflict, biodiversity loss is one of the greatest societal costs.

What are the main factors driving biodiversity loss and their implications?Rising population levels, urbanisation, deforestation, overgrazing, and land degradation are the main causes. According to the Global Footprint Network, the planet has an available average of 1.7 hectares of biologically productive land per person to supply resources and absorb waste, yet the average person uses 2.3 hectares worth. These ‘ecological footprints’ range from 14.4 hectares per head in Qatar to the 8.1 hectares claimed by the average American and 0.5 hectares used by the citizens of Timor-Leste.

According to a report by The Economics of Ecosystems and Biodiversity, a global initiative that seeks to mainstream the values of biodiversity into decision-making at all levels, agriculture causes around 70% of the projected loss of terrestrial biodiversity. “In particular, the expansion of cropland from grasslands, savannahs and forests contributes to this loss.” The commodities most linked to deforestation are cattle, palm oil, soy, timber, coffee, rubber, and cocoa, which are being farmed in countries such as Brazil, Argentina, China, India, Indonesia, Malaysia, Ivory Coast, and Ghana.

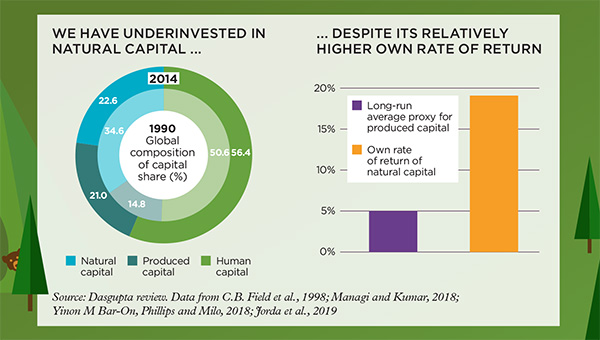

What is the role of the investor community when it comes to biodiversity?Investors can take a proactive role in demanding that their investee companies implement a commodity-specific no deforestation policy. This could also apply to establishing a verification system for supplier compliance with the company’s no deforestation policy. Such efforts are outlined in the Principles for Responsible Investment ‘call for corporate action on deforestation’, which was announced in September 2019. Investors can also promote investments, engagement, public advocacy and disclosure that address biodiversity. However, improvements in datasets are required to facilitate a more robust integration of biodiversity into the investment process. Advancements in this area will come, helped by the Dasgupta review on the economics of biodiversity (the interim report of which was published in April 2020), as well as steps to replicate the Task Force on Climate-related Financial Disclosures when it comes to nature-based disclosures.

About the expert

Michael Lewis is head of ESG Thematic Research at DWS.

See Michael on CISI TV

- Defining ESG within emerging markets

- Money managers: the new warriors of climate change

Michael.Lewis@dws.com

How can we target investments that address biodiversity loss?We typically frame our environmental, social and governance (ESG) investment strategies through the lens of the UN’s Sustainable Development Goals (SDGs). Not surprisingly, biodiversity is linked with several of the SDGs, such as carbon sequestration to address SDG13 ‘climate action’, as well as natural water filtration providing SDG6 ‘clean water and sanitation’. Similarly, SDG14 ‘life below water’ and SDG15 ‘life on land’ sit alongside the benefits biodiversity confers in terms of agricultural yields, which support SDG2 ‘zero hunger’ and SDG3 ‘good health and wellbeing’.

In our experience, private equity and private debt investments have been the best investment solutions to address key environmental and social issues, for example in supporting agricultural systems in Africa. However, public market investments also have a role to play, particularly in encouraging companies to invest in technologies that improve agricultural productivity.

Can biodiversity loss be arrested through new technologies?Technologies are being introduced in areas such as smart farming. According to a report on water scarcity by WWF, agriculture accounts for 70% of the world’s total freshwater withdrawal (mostly through irrigation), but some 60% of this is wasted due to leaky irrigation systems and the cultivation of crops that are too ‘thirsty’ for the environment in which they grow. Solutions include recycling wastewater, rainwater harvesting, drip irrigation technology, precision planting and hybrid seeds, improved infrastructure and pipes, and the introduction of desalination facilities. In addition, lab-grown meat from cultured cells could cut the environmental costs of producing meat and eliminate the unethical treatment suffered by animals that are raised for food.

This article was originally published in the October 2020 flipbook edition of The Review.

The full flipbook edition is now available online for all members.

All CISI members, excluding student members, are eligible to receive a hard copy of the quarterly print edition of the magazine. Members can opt in to receive the print edition by logging in to MyCISI, clicking on My account, then clicking the Communications tab and selecting 'Yes'.

Once you have read the print edition, keep coming back to the digital edition of The Review, which is updated regularly with news, features and comment about the Institute and the financial services sector.