Blockchain empowers some digital currencies, but other sectors can also benefit from the technology, from healthcare to consumer goods

by Rebecca Campbell

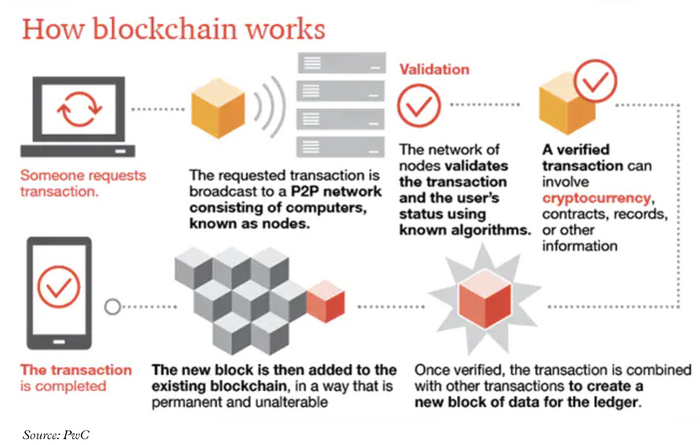

Blockchain technology creates a decentralised database or ledger that enables participants to reduce their reliance on third parties, essentially taking trust out of the equation, when exchanging information, such as financial data or digital assets including artworks, videos and other files.

"From a business perspective," according to PwC, "it’s helpful to think of blockchain technology as a type of next-generation business process improvement software", with practical applications including fund transfers, settling trades, casting, counting and verifying votes and encrypting patients' health information. Benefits include increased transparency, accurate tracking, permanent ledgers and cost reduction. Unknowns include the regulatory implications, implementation challenges and competing platforms.

The technology came into the public sphere with the beginning of the cryptocurrency bitcoin in 2009. A cryptocurrency is a medium of exchange that is stored in the blockchain, and because of its decentralised technology, allows users to make secure payments without a bank or financial institution attached.

Blockchains are networks of nodes (see boxout) that validate and copy information via algorithmic consensus, explains Peng Zhong, CEO of Tendermint, one of the core teams building the blockchain ecosystem Cosmos.

"This data is then encrypted into blocks, and broadcasted and validated by each node before being added to a chain, hence the word blockchain," Peng adds. "As the information is held across every node in the network, blockchain technology has no single point of failure or centralised servers that are vulnerable to attack, therefore making it extremely robust." It is this technology that powers bitcoin, which remains the number one cryptocurrency by market capitalisation.

Two core building blocks underpin blockchain technology: private keys (cryptography that allows a user to access their cryptocurrency) and public keys (created from the private key through a mathematical algorithm), which enable users to securely transact on the ledger, and a timestamp server, which certifies that an entry was made at a particular time and date. This is where the Proof-of-Work (PoW) consensus comes into play (see boxout). As Peng explains above, all nodes across the network must agree on the validity of the information, thereby maintaining the integrity of the data added to the blockchain.

"These qualities make blockchain extremely flexible and generate an untold number of use cases beyond cryptocurrency, from expediting payments, removing opaque practices in supply chains and securely storing data, to authenticating manufacturing equipment, Internet of Things (IoT) devices, or even digital works of art," says Peng.

Bitcoin may have accelerated the cryptocurrency sector but thousands of others have since entered the field. At the time of writing, that number stands at 10,852, according to CoinMarketCap. Many of these have little to no following or circulating volume, while plenty of others enjoy immense popularity.

Notable examples

Ethereum is a blockchain-based platform that enables users to code and run their own decentralised applications and produce smart contracts with its native coin, ether, the second largest cryptocurrency by market capitalisation. While it can conduct 20 transactions per second compared to bitcoin’s seven, it has no maximum circulating supply, which could make it inflationary.

Ripple (XRP) is the cryptocurrency that supports its blockchain payment network RippleNet. RippleNet is widely used by global financial establishments, including American Express and Santander, because of its products that enable cross-border payments. XRP can supposedly process a payment in three to five seconds and handle around 1,500 transactions every second.

Stellar lumens are the native cryptocurrency for payment network Stellar. Stellar operates similarly to RippleNet and can process transactions in several currencies. While stellar lumens integrate with banks, such as Banco Bradesco from Brazil and Bank Busan of South Korea, it is not as widely recognised as some others.

EOS is the crypto asset that powers blockchain platform EOS.IO, which allows developers to build decentralised applications. In order to use network resources to build and run decentralised applications, a developer needs to hold EOS coins. Supported by a web toolkit for interface development, EOS provides a hassle-free way for developers to create apps.

Future opportunities with blockchain

Blockchain’s use beyond digital currencies is vast. It is already being adopted in many sectors, particularly supply chains. Thanks to the technology’s transparency, companies can track and trace items from their origin to their final destination.

Blockchain's influence is already being felt in the exchange-traded fund (ETF) arena. In April 2018, First Trust Global Portfolios launched an Undertakings for Collective Investment in Transferable Securities (UCITS) blockchain ETF called BLOK. It tracks the Indxx Blockchain Index, which tracks the performance of the 100 largest companies in the world that are either enabling blockchain technology or using it. Gregg Guerin, senior product specialist at First Trust Global Portfolios, says the ETF was launched because "blockchain has the potential to impact a wide array of sectors and companies, much like the internet over the past few decades" and the "index seeks to give exposure not just to companies that directly benefit from implementing or selling the technologies".

Gregg thinks we'll see more blockchain ETFs in the future "in many shapes and sizes and in the same vein as we have seen a proliferation of 'internet' ETFs, such as cloud computing, cybersecurity and ecommerce represent several ETF offerings based on internet technologies," he says.

"Any sector or process which would benefit from decentralisation is likely to benefit and therefore use this technology"

As witnessed with Covid-19, disruption with a supply chain can have a drastic effect on a company’s operations, particularly those that function with several middlemen. Blockchain solves this by providing all parties with a universal source of truth that removes inefficiencies and errors while generating cost savings. Walmart, for example, is using blockchain to ensure traceability of products. And two British hospitals are reportedly using blockchain to track the storage and supply of temperature-sensitive Covid-19 vaccines. In the aviation sector, blockchain can be used for frequent flyer points by tokenising – the process of replacing data with unique identification symbols that retain information – these assets, according to an October 2018 report by the International Air Transport Association. Tokenisation can help ease accounting for and reconciliation of data. Blockchain can also be used in tracking the status and location of baggage and cargo, and passenger and crew identity management, says the report.

Banks are starting to utilise blockchain too. For example, in April 2021, the Inter-American Development Bank (IADB) and Citi Innovation Labs concluded a successful proof of concept for cross-border payments from the US to Latin American countries and the Caribbean using blockchain and tokenised money. This would provide full traceability of transactions, exchange rates and fees, says an IADB press release .

However, while blockchain has been useful for many other sectors – land and building ownership records, carbon footprint tracking, banking, and where verification of authenticity is important – it’s not the silver bullet for everything, according to Gavin Brown, associate professor in financial technology at the University of Liverpool.

"Any sector or process which would benefit from decentralisation is likely to benefit and therefore use this technology," says Gavin, adding that it can also "give rise to blockchain being the recommended solution of choice by consultants from all business challenges".

Potential disruptionWhile the technology is certainly demonstrating its potential, we’re still in the very early stages of blockchain, Peng says, noting that "the convergence of blockchain with other emerging technologies like IoT and artificial intelligence will also be very interesting to see."

But Andrew Kessler, chief technology officer at Switzerland-based Zenotta, a peer-to-peer electronic trade system, predicts that the technology will move away from its true potential, at least in the short term.

According to Andrew, while a blockchain is a type of distributed ledger technology (DLT), not all DLTs are blockchains. This includes many central bank and enterprise DLTs.

"In the short term, enterprise will be buying a lot of DLT, but will not be investing in the true blockchain space [and it’s] banks and enterprise that will be on this path the longest. Ultimately, as users adopt more real blockchain technology, enterprise will learn the difference and correct," says Andrew.

"In a very rapidly changing technical environment, the regulator inevitably ends up three steps behind"

In his view, it’s only when the market becomes educated and people start to appreciate that they can do things differently will we witness significant disruption.

Some disruption is already being felt in areas of society such as finance, voting, ownership, healthcare, and travel. For example, the Korean government has approved a pilot of a blockchain-based voting system, which could be used by more than ten million people.

Some of the benefits that businesses are appreciating now include transparency, efficiency, and proof of ownership. By using blockchain, businesses can drive greater veracity, reduce human error, limit unnecessary paper trials, and boost productivity, making everyone’s job easier. Yet, while the technology is making waves in certain sectors, Andrew is of the view that the technology hasn’t matured to the point where any form of regulation makes sense. He believes that it’ll be another ten years before a thought-out regulatory framework is seen.

"In a very rapidly changing technical environment, the regulator inevitably ends up three steps behind, and the gap between the two is where opportunists are driving the hype cycle, further damaging the reputation of the underlying technology," he says. Examples of these opportunists include an initial coin offering (ICO) that started as a US$575m token sale and is now a rewards programme for watching videos, and various celebrity endorsed ICOs.

Looking to future opportunities with blockchain, Andrew is of the view that the technology can "provide a new framework for economics and law", adding that it can also help determine what fake news is. "Blockchain can help deduce what gives me the right to access a file through permissioned computational services," he says. "When authors can publicly sign their data or content as their property, such as news, readers can check their news source against the blockchain entry, realising for themselves which news comes from a known author and which news has no author attribution. Accountability and audit at machine level will provide users with a simple way to minimise fake news."

Environmental, societal, and governance impact

Of course, when talking about blockchain, it’s hard not to mention the environmental, societal, and governance (ESG) impact of cryptocurrency and blockchain and the advancements being made in energy usage.

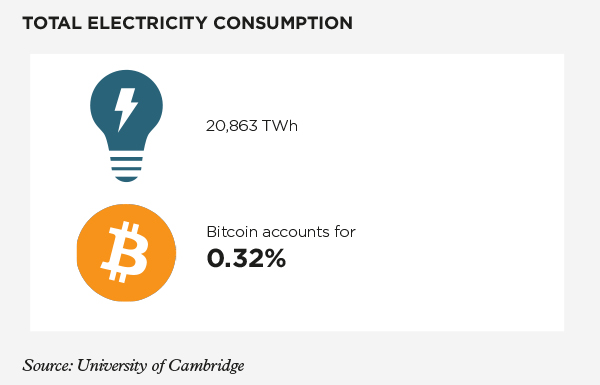

Cryptocurrency, in particular bitcoin’s energy consumption, has come under fire lately, especially since Tesla announced that the company would no longer accept it as payment for cars. This was due to its concern over the increasing use of non-renewable energy sources to mine bitcoin. The University of Cambridge is one source that compiles an index on bitcoin’s energy consumption and shows that since the origination of bitcoin, it has consumed around 0.32%, or 20,863 terra-watt hours (TWh), of all global electricity. Annually, this figure is 70.75 TWh, putting it behind Chile and in front of Bangladesh in terms of electricity consumption.

"Many argue that the energy efficiency of the existing global financial system is likely much worse, notwithstanding the societal benefits that cryptocurrencies can bring in banking the unbanked and underbanked," says Gavin. "This latter point is particularly important in many developing economies."

Andrew adds that the impact of any new technology is always large, and that "there’s always a correction at a certain point in maturation, where the energy costs come down". He argues that the advances in energy usage, for the large part, have been a waste of time, sacrificing the fundamental model of what blockchain can achieve and that "advancement for advancement's sake is a dangerous model for development" as context is required.

"Proof-of-Stake (PoS) has 'solved' the energy consumption of blockchains by making them not blockchains," he says. "PoS is not an equal opportunity algorithm and does not incentivise independence of the ledger. Rather, pursue PoS and the correct energy requirements with better technology instead of throwing the baby out with the bath water." (See boxout)

Moving parts

PoW is the current consensus mechanism used by many leading cryptocurrencies. However, this is slow and energy inefficient. Altcoins such as ethereum are moving towards an upgraded PoS consensus model, which will improve speed, capacity, and energy efficiency, thereby lowering fees, says Gavin.

PoS will reduce the network’s energy consumption by 99.95% because it doesn’t require as much energy computation as PoW. The mechanism relies on ‘validators’ (someone who is responsible for verifying transactions on a blockchain) to order the transactions into blocks by attesting that the information in them is correct. These individuals verify the legality and accuracy of every incoming transaction. A transaction will only be completed on the blockchain once it's verified by a validator. PoS requires validators to ‘stake to win’ blocks, i.e. users are holding, freezing, or staking their assets in a cryptocurrency wallet to help support the security and running of a blockchain. Most PoS blockchains require a minimum number of coins to start staking, which requires a large investment upfront. The more coins they stake, the higher their chances of winning. Unlike PoW, which rewards miners each time a block is verified, PoS awards validators with the transaction fee. Yet, while PoS and Proof-of-Authority (PoA) are more sustainable and deliver a secure energy-efficient framework, they also reintroduce central control that offers nothing more than a weaker version of a bank, says Andrew (see boxout).

Blockchain’s evolutionary process is still considered to be at the Netscape stage of the internet, i.e. the very early stages

PoA is a consensus mechanism that relies on a validator's reputation, rather than staking coins, to produce blocks. PoA uses a limited number of pre-approved validators to produce blocks.

"Moving to PoS and PoA will just allow banks and intermediaries to double down and recontrol the system, eliminating any real social impact for the average person," he adds. "[Instead], we should be trying to drive down the energy consumption on PoW."

Blockchain’s evolutionary process is still considered to be at the Netscape stage of the internet, i.e. the very early stages. Yet, while it will take years to see the full extent to how it can change people’s lives for the better, the technology has come a long way already. Bitcoin was the first application allowing for the peer-to-peer transfer of value with a decentralised currency. Ethereum followed, enabling decentralised applications to be built on top of it, allowing for the widespread use of smart contracts.

"Both of these have shown enormous innovation and gained massive traction," concludes Peng. "But they also show limitations when it comes to throughput and scaling. At the moment, most blockchains remain siloed and are unable to communicate with each other. The future is not one chain emerging victorious, but rather many chains enriching an interconnected ecosystem for all."