The financial services profession’s confidence in the UK’s economic prospects has improved over the last 12 months, according to the latest Chartered Institute for Securities & Investment (CISI) survey.

The CISI, the 45,000 strong professional body for those working in securities, investment, wealth management and financial planning undertook the survey from 4 November 2017 – 18 February 2018.

Of the 743 respondents, 35% were less optimistic about the UK’s economic prospects (compared to 48% end 2016). Of those who responded, 30% felt more optimistic, with 35% unchanged (as opposed to 32% optimistic and 20% unchanged end 2016).

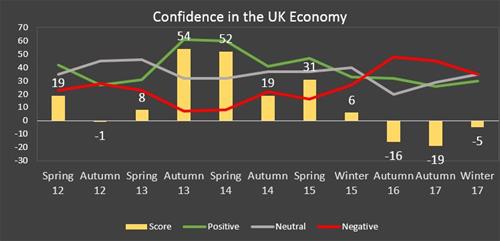

The CISI confidence indicator (sum of positives less sum of negatives) is -5 compared to -16 at the end of 2016.

Respondents were asked to compare how they felt about the UK’s economic prospects now compared with six months ago. The CISI has conducted the poll on average every six-12 months since Spring 2012.

Simon Culhane, Chartered FCSI, CISI CEO said: “Although we are still sub-zero at -5 in terms of sentiment, the financial services profession is showing a steady and improved growth in confidence in outlook for the UK economy, compared with the end of 2016.

“The result of our survey is in line with the latest forecast for the outlook for manufacturing for the year, with that sector expecting expansion by 2% according to the EEF manufacturers’ organisation.

“The confidence level in our survey peaked in Autumn 2013 at 54%. From my own conversations with UK financial services CEOs I believe it is possible that our profession’s confidence levels in the UK’s economic outlook will become even more positive once we have moved beyond Brexit.”

Respondents’ comments to the survey included:

- “As expected the UK is suffering slightly from the political uncertainty and slight pull-back in real wage growth.”

- “My experience of travelling a little around the country is that the UK is booming. I find the gloom and creation of uncertainty is a London Westminster/City bubble thing, where people not venturing outside of the M25 do not see the bigger UK picture and have their opinions dominated by London media perspectives. There is unnecessary pessimism, a feature that soon becomes “group think” meaning that economic commentators are afraid of not following the herd and having a positive outlook.”

- “MIFID2 is a huge ask with Brexit hanging over us still.”

- “The world, including the UK, is sinking in a pool of debt fuelled by short term gratification (and “stuff”) required by an increasing proportion of people. This could be a downward spiral which will be very hard to break.”

- “The reality of Brexit is starting to take hold and it’s becoming obvious that the EU have the upper hand in the ensuing negotiations. Whilst I believe the UK will survive, it will certainly come at a huge cost. If you have a fight with a lion and survive, you can expect to emerge from the ordeal with significant bruises and scars!”