Over 89% of financial services practitioners believe that today’s students are paying too much for university, according to the latest online survey by the Chartered Institute for Securities & Investment (CISI).

The CISI, the professional body representing those working in the financial services sector, ran the survey for 14 weeks, attracting 680 responses.

The online survey asked: “UK academic fees are usually around £9,000 per year which means the average student has total debts, including expenses and accommodation, after three years study of over £50,000. However, attaining a degree brings the holder, on average, a lifetime financial advantage of over £100,000. So, how much would you suggest a student in the UK should pay to obtain a three year university degree?”

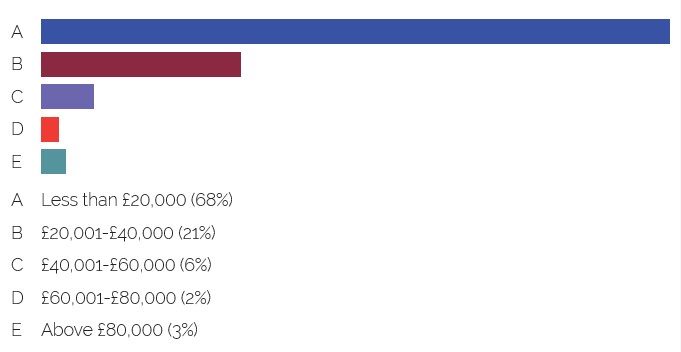

68% of respondents suggested an appropriate cost would be “less than £20,000” and 21% “£20,001-£40,000”. Just a small minority (5%) suggested that students should pay “£60,001+”.

CISI CEO Simon Culhane, Chartered FCSI said: “We first raised the question in 2010 of whether obtaining a degree is really the best option for young people. There are simply not enough graduate jobs, which is why too many graduates are entering the employment market in jobs for which they are overqualified. Before deciding to enter higher education, individuals should consider the subject they wish to study, the degree classification they are likely to achieve and the institution they plan to attend. These factors greatly impact on whether university is ‘worth it’. In many cases, an apprenticeship may be a better option.”

Comments from respondents included:

“I don’t feel that the opportunities, job market and salaries justifies that amount of debt.”

“We`ll see the financial advantage of a degree diminish over the next few years.”

“Looking at it from an investor perspective, investing £50,000 in three years and earning £100,000 for the rest of your life is a bad investment.”

“The three-year degree model is an anachronism which needs to be updated for today`s world. Two years is quite sufficient.”

“Students should not get in lifetime debts for a piece of paper that doesn`t contribute to today’s employment requirements.”

Several respondents suggested refining the current loan-repayment system, based on success post-university:

“It should be funded centrally with incentives based on outputs. Then the recipient should have a personal income tax levy for a number of years. So, say a student with a 1st would leave university and then pay an extra 2% income tax for five years.”

“Introduce a success-based tax, say university affiliation tax of 5% pa of gross earnings for life, with perks of say stronger alumni network schemes.”

However, others were more supportive of the current system, commenting:

“There is a cost associated with higher education that cannot necessarily be borne by the normal taxpayer.”

“It is fair enough to have students paying a fee, at least a minimum. I consider it as a way to support the academic system. Furthermore, the UK offers a good education to its citizens.”

How much would you suggest a student in the UK should pay to obtain a three year university degree?

Figures have been rounded to the nearest whole number.