The Chartered Institute for Securities & Investment (CISI) has announced a key project in the Philippines to support the country’s compliance with anti-money laundering and counter-terrorism financing (AML/CTF) requirements.

The CISI is a Royal-Chartered, not-for-profit UK professional body for those who work in the financial services and investment profession worldwide. With 45,000 members globally and qualifications recognised by 61 regulators, its regional headquarters for Asia Pacific are in Manila.

The CISI has created an online cost-effective AML/CTF professional assessment module to meet the standards required by the Anti-Money Laundering Council (AMLC) of the Philippines.

We are delighted that CISI has been formally accredited by the AMLC to offer the Philippines an e-learning and training programme that is written to the AMLC’s exacting standards.

The CISI professional assessment consists of an online learning workshop and test, and it provides the AMLC with a unified record of compliance. Full access to this thorough, international, gold-standard assessment tool is available nationwide, reflecting the quality and competitive value that CISI offers, by being both a global, professional membership body and a charity.

All individuals who work with money, directly or indirectly, are required to evidence their compliance with AML/CTF training and assessment annually. These include those supervised or regulated by the Bangko Sentral ng Pilipinas (BSP), Securities and Exchange Commission, and Insurance Commission as well as designated non-financial businesses and professions (DNFBPs), casinos, and other covered persons listed in Republic Act Nos. 10365 and 10927.

Under the 2018 Implementing Rules and Regulations of RA No. 9160, otherwise known as the Anti-Money Laundering Act of 2001 (AMLA), as amended, “covered persons shall develop or create opportunities for continuing education and training programs for its directors, officers, and employees to promote AML/CTF awareness and a strong compliance culture.”

Test details

Beginning in May 2020, firms will be able to register their staff to undertake the CISI e-learning training and assessment module.

It will no longer be necessary for individuals to attend third-party centres for instruction and testing as this can be done online at any time of the day or night.

CISI recommends a minimum of two hours of studying the module before attempting to answer the 24-minute, 24-question test. The pass mark is 75%.

The learning and assessment is priced at PhP1,250. Should they be unsuccessful on their first attempt, users will be permitted to retake the test once.

The learning and test is available via a link on the AMLC website at amlc.gov.ph.

Simon Culhane, Chartered FCSI, CISI CEO, said: “We are honoured to be able to support the AMLC in its commitment to ensuring robust training and competence standards for those working in the Philippine capital markets.”

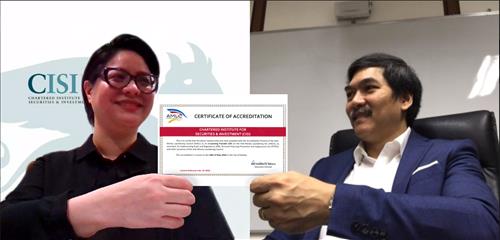

Andrella Guzman-Sandejas, Regional Head, CISI Asia Pacific, (left in photo) said “We are excited to offer an affordable, accessible, readily-available, online solution that will help to increase the effectiveness of all staff to fight money laundering and terrorism financing.”

Mel Georgie B. Racela, Executive Director of the AMLC Secretariat (right in photo) said: “We are always pleased to have partners in building AML/CTF capacity among our local stakeholders to ultimately eradicate money laundering and terrorism financing in the Philippines.”

Richard Colley, Director of Trade and Investment of the British Embassy Manila said: “I would like to congratulate AMLC and the Chartered Institute for Securities & Investment on this important partnership. We are delighted that the UK and the Philippines will be working together in this critical area of work to help combat money laundering. The CISI is a world leader in promoting integrity in the global financial services profession and we are excited by this work here in the Philippines.”

For further information on how to access the AML/CTF modules, contact AsiaPacific.Office@cisi.org.