The FCA consultation document on replacing the TVA with APTA (Appropriate Pension Transfer Analysis) has suggested that Cashflow Modelling software could help consumers understand the complexities of DB transfers. But they’ve also expressed concerns about consumers’ ability to understand the outcomes of stochastic modelling. So how can Cashflow Modelling help you, as an adviser, deliver the best possible outcomes for your clients?

Since 1984, Prestwood has offered a largely deterministic cashflow modelling tool to UK planners. We think it’s transparent, and helps clients answer key questions about the important financial decisions in their lives. We also have a stochastic calculator within our software, which will allow you to calculate the probability of achieving a goal either in accumulation or decumulation, but in our eyes stochastic modelling isn’t (and shouldn’t be) the be-all and end-all.

Starter for 10 – what on earth are Stochastic and Deterministic Modelling?

For those who are uncertain of the difference, here it is in a nutshell:

- Deterministic modelling assumes there is no randomness.

- Stochastic modelling allows for randomness (within limits).

In other words, in a deterministic model you control all of the variables (such as inflation, growth, expenditure…). In a stochastic model, we allow probability to decide what the value of one of the variables will be: in this case – investment growth.

Here’s one I made earlier

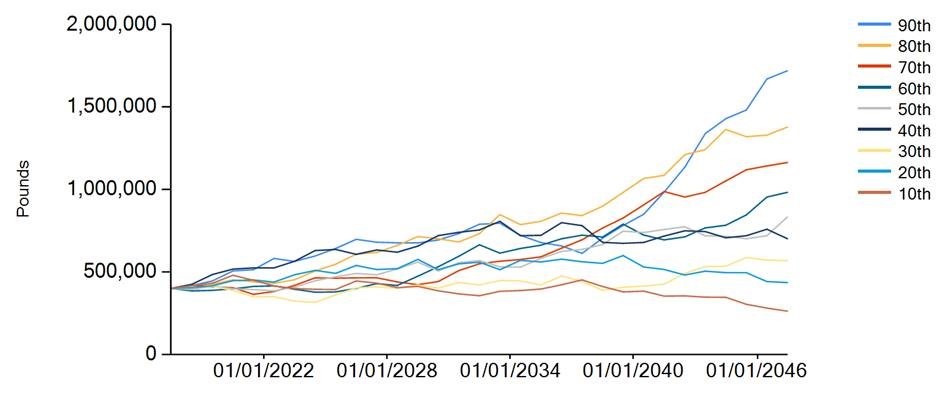

(Based on £400,000 invested in OMW Balanced Life fund, with 4% (£16,000/annum) annual withdrawals taken in arrears escalating at 2% per annum over 30 years)

I asked our stochastic calculator if a client could achieve 4% withdrawals from their £400,000 pension pot for 30 years. And fantastic news: it said YES! There’s a 96.24 chance of success. Great. But what does that mean, and is 4% enough?

In terms of what it means – we ran 10,000 simulations, based on the average growth and volatility of their portfolio, and in 96% of cases they had at least £100k remaining after 30 years. There were only 376 out of 10,000 simulations where they were below their “comfort zone” after 30 years.

So what?

Good question!

A stochastic simulation helps prove to the client that, potentially, their advised DB transfer might be a good idea. While in their DB scheme, their income is guaranteed for life, but their transferred pension might be able to give a similar (or better) income, and there’s a 96% chance it will do so. This picture shows a 96.24% chance of “success”… but it hasn’t shown whether it’s enough for the client to enjoy their desired retirement lifestyle.

Is 4% enough? What if they wanted to take ad-hoc withdrawals? What if their daughter is getting married in a couple of years, and they intend to splash out on a lavish wedding? Or maybe they just fancy a once-in-a-lifetime holiday, after 40 years in the world of work?

The advantage of a comprehensive lifelong cashflow model is that it takes into account all of the client’s lifestyle goals and objectives. Even the silly ones.

Why deterministic is clearer

In brief, because (as we established at the start) there’s no randomness.

Nobody is going to pretend that the client’s pension is going to grow at precisely 6.3% for the next 30 years, but it’s fair to say that that’s the fund manager’s goal. The advantage of assuming that there’s one specific growth rate is that we can perform a direct and straightforward comparison between two scenarios.

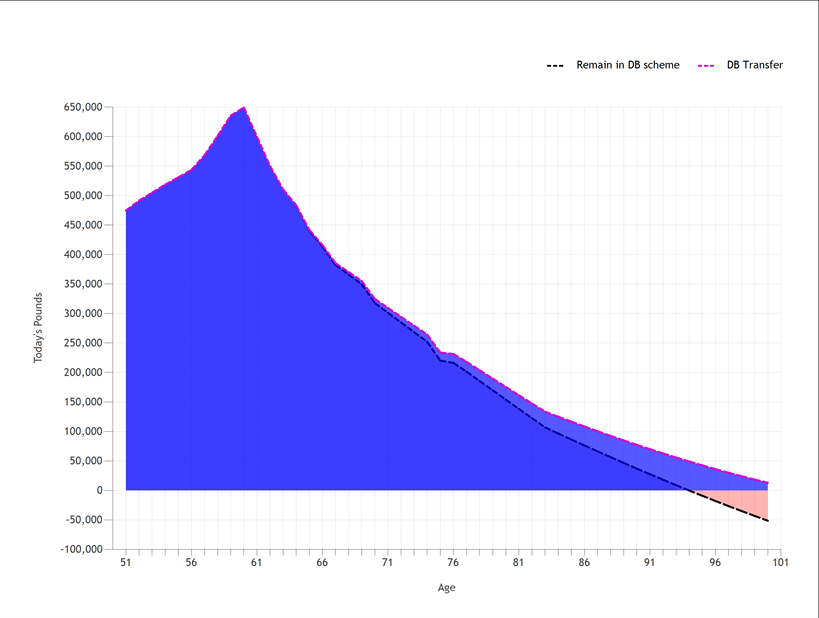

Here’s the same client’s deterministic cashflow model in Prestwood’s cashflow modelling software Truth®. Our capital chart shows a client’s liquid capital, and how this changes over their lifetime. It allows you to see whether, based on their current plans, your client has enough money to live their desired lifestyle.

As the old saying goes: a picture paints a thousand words.

This chart speaks for itself, and is simple for consumers to understand. If they remain in the DB scheme, they don’t quite have enough money to realise their goals. If they take an escalating income from their transferred pot (at the intermediate rate of return), they do.

We need to know more…

This information on its own isn’t enough. The stochastic model says we have a 96% chance of being able to continue withdrawals for 30 years. Great. The deterministic model shows we’re better off in an unsecured pension than our current DB scheme. But we need to know more.

The big questions we need to ask are the “what-ifs” – what if the client were to die prematurely? What if they were disabled? What if there were a catastrophic market fall on the day before they took benefits from their uncrystalised fund?

That’s why clients need to come back year after year – to ensure that they remain on track.

Digging deeper…

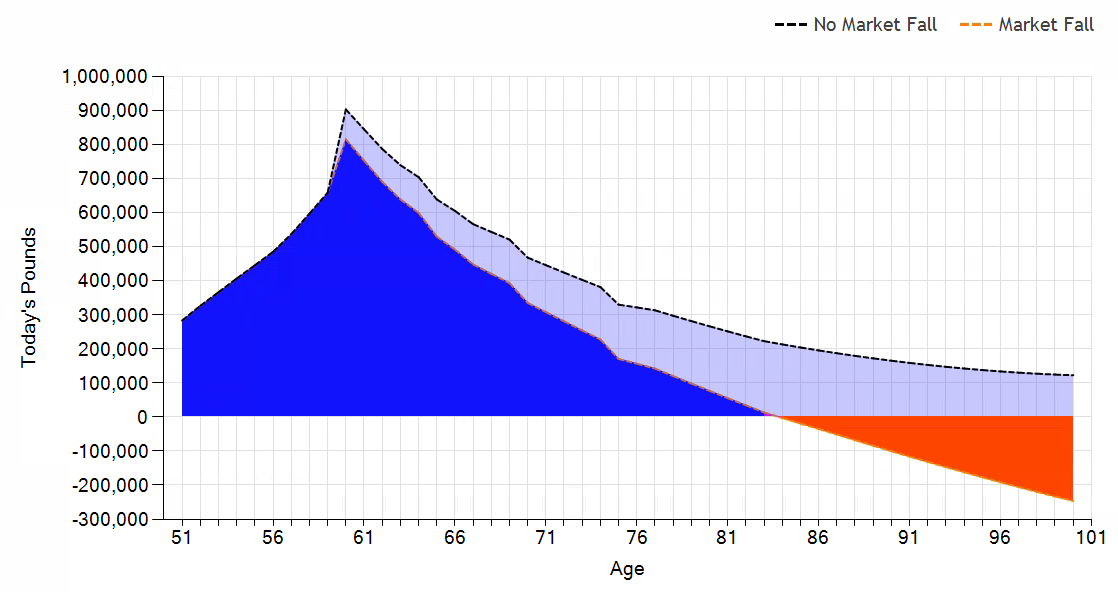

Risk is a big concern with any DB transfer. One of the primary reasons for advocating NOT transferring out of DB schemes is that they’re cast-iron, guaranteed sources of income in retirement. There’s almost zero exposure to market risk (providing their old employer isn’t owned by Sir Philip Green). The ability to show the effect of a market crash helps illustrate to the client the potential impact not only on their cashflow, but on their lifestyle in retirement.

Here’s our capital chart. Remember, this shows Michael’s liquid capital over his lifetime if he were to transfer his pension. He reaches age 100 with around £150,000 capital remaining. But look what happens to if he were to experience a 30% market fall immediately before retirement:

Suddenly, Michael is £300k short of the lifestyle he wants to live in retirement!

In reality, they wouldn’t REALLY run up a £300k overdraft – planning exercises would take place to prevent this. Therein lies the value of the annual review! But what IS true, and evident from this chart, is that Michael’s retirement lifestyle might be at risk outside his DB scheme.

Let’s de-risk…

Let’s see the impact of reducing the exposure by moving Michael to a portfolio with lower return, but less risk. In Truth, you can do this really easily using our Growth Calculator.

The Growth Calculator allows you to calculate how much more growth a client needs to achieve in order to meet their cashflow goals… but it also works the other way. If a client has sufficient capital, but is uncomfortable with the level of risk they are exposed to, this handy tool will tell you how much LESS growth they can achieve, without going below a threshold of your choosing.

Let’s see how much growth Michael needs in order to prevent his liquid capital dropping below £100k by age 100:

Michael’s transferred pension, based on his risk profile, is targeting 5% growth. This shows us that he could actually afford to lose 2.18% of this (i.e. target 2.72% return), and still have £100,000 at age 100. Moving to a less volatile portfolio might well help address any concerns about market risk exposure.

Death and taxes!

Historically, one of the key features of DB pensions was their generous death benefits compared to an equivalent personal pension. However, since Pension Freedoms, the playing field has been levelled significantly.

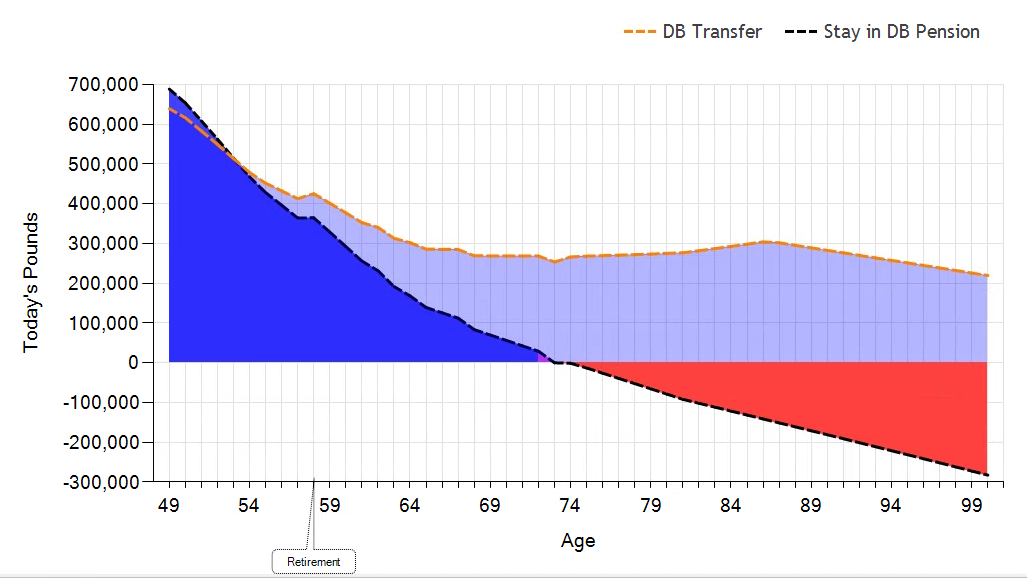

Let’s look at the NHS pension scheme as an example. Depending on when you were a member of the scheme, you might be looking at 5 years’ pension income as a lump sum, followed by 50% of pre-death pension to your nominated beneficiary.

In Michael’s case, he’s taking an income of £12,000 from his DB scheme. Jane, his partner, would receive a lump sum of £60k, then an income of £6k/annum for the rest of her life. This income would potentially be taxable.

The transfer value offered by Michael’s old employer is £420,000. Under Pension Freedoms, Jane would be entitled to all of this as a tax-free lump sum. Alternatively, she could take a tax-free dependent’s drawdown, leaving the pension invested.

Let’s take a look at how these two options compare:

If he were to stay in his DB scheme, Jane would receive a lump sum up-front. However, the income of £6k/annum isn’t enough to sustain her in retirement. When her state pension kicks in, she starts paying tax on a portion of her income.

If he were to transfer out of his DB scheme, Jane could take £12k/annum tax-free until the pot is depleted (that’s the “bump in the road” at her age 85). She would have sufficient liquid capital to live the life she wants in Michael’s absence.

To find out why we’re the UK’s leading cashflow modelling software, take a look at our website

www.truthsoftware.co.uk

by Adam Leci, Prestwood Software

Prestwood are the leaders in client facing financial planning software. In 2007 they launched 'Truth®' which has since helped hundreds of advisers move to more profitable financial planning models. Truth is easy to use with clients thereby creating powerful client relationships. It moves the focus off products and investments to what matters most – helping clients identify, achieve and maintain their desired lifestyle.